Fourth consecutive win for HSBC Sri Lanka! Awarded Best Consumer Digital Bank in Sri Lanka at the World’s Best Consumer Digital Bank Awards in Asia-Pacific by Global Finance for 2024. HSBC Sri Lanka also won Best Mobile Banking App and Best Information Security and Fraud Management awards.

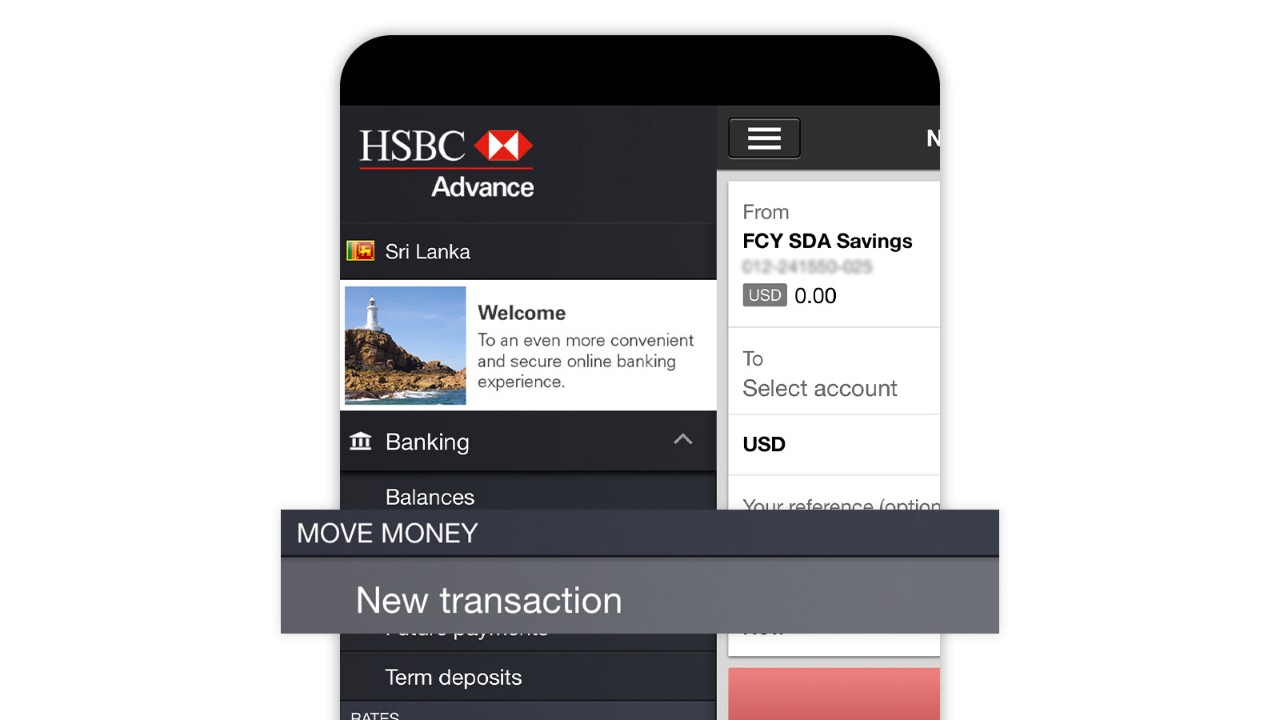

Do your banking anywhere

Stay in control of your finances easily with our mobile banking app. Whether you're checking your balances or setting up new transactions, the app lets you do your banking wherever you are.

Here's how the app will assist you

Keep a close eye on your transactions

Accessing your account balances and monitoring your incoming and outgoing money has never been this simple.

Move/transfer money with ease

Send money to new or saved payees in just a few seconds. Transfer money to own accounts, to other accounts at HSBC or to local banks and make bill payments from the app itself.

Do your international banking

If you're an HSBC Premier or Advance customer in Sri Lanka with HSBC accounts overseas, you could choose International Banking. Click here to learn more about Global Transfers with the app.

No physical security device

With a security device built into the app, you'll never need to carry anything additional around with you to do your banking.

Open term deposits

Conveniently open term deposits on the go using the HSBC Mobile banking app.

Get the app

Download the app and use it straightaway.

The official HSBC Mobile Banking app can only be downloaded at Apple App Store™ and in Google Play™ by searching "HSBC Mobile Banking".

Click below for iOS users

Click below for Android users

Learn how to register for HSBC Mobile Banking App

HSBC Mobile Banking App tutorial video

Watch the video tutorial to learn how to register for HSBC Mobile Banking to get started.

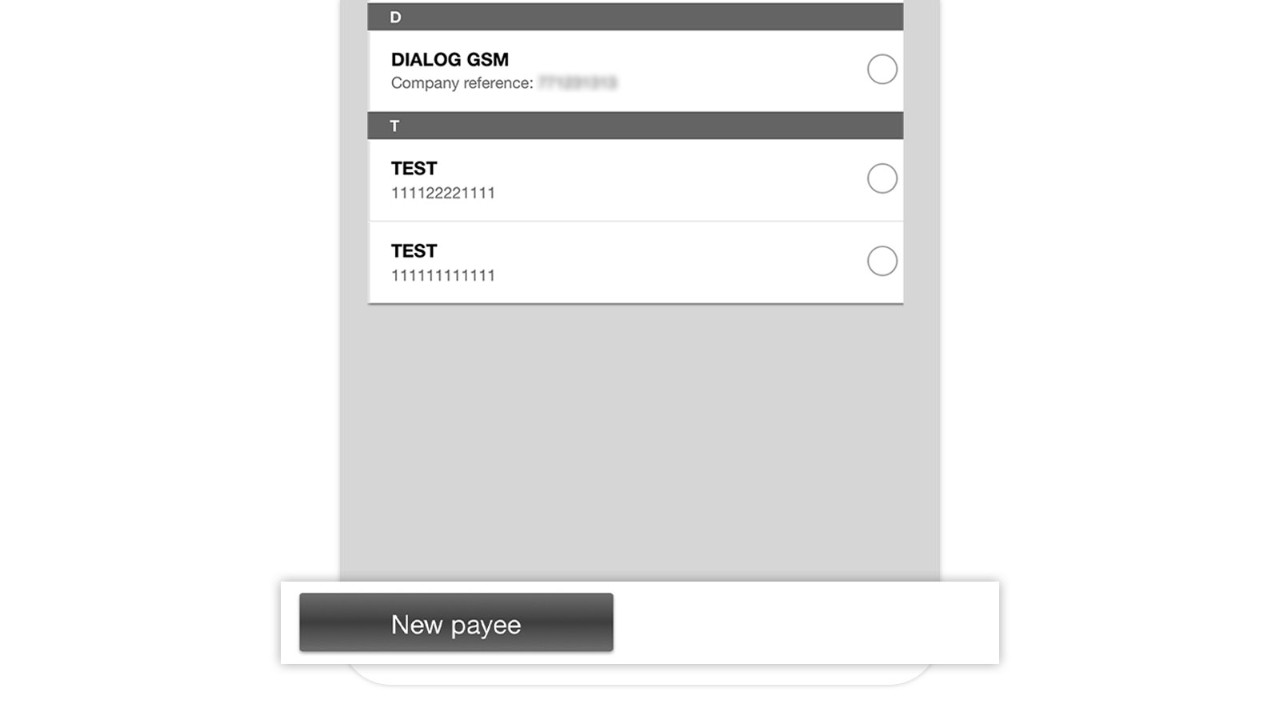

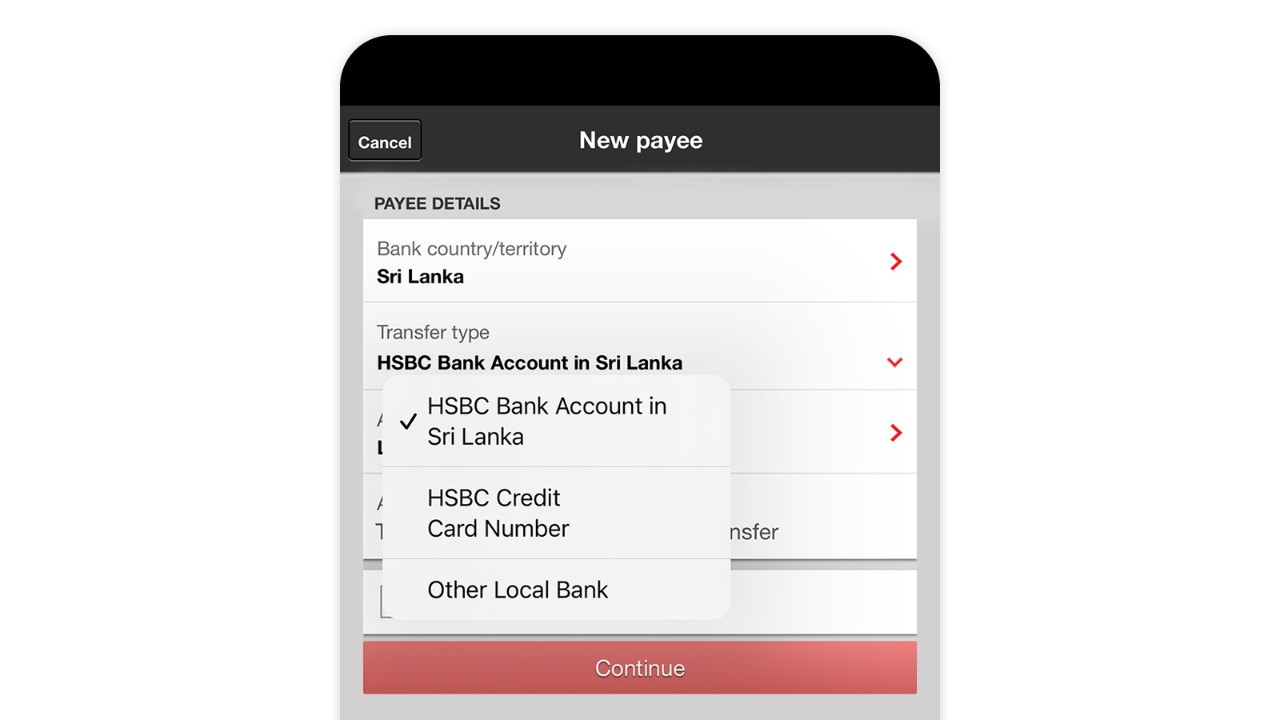

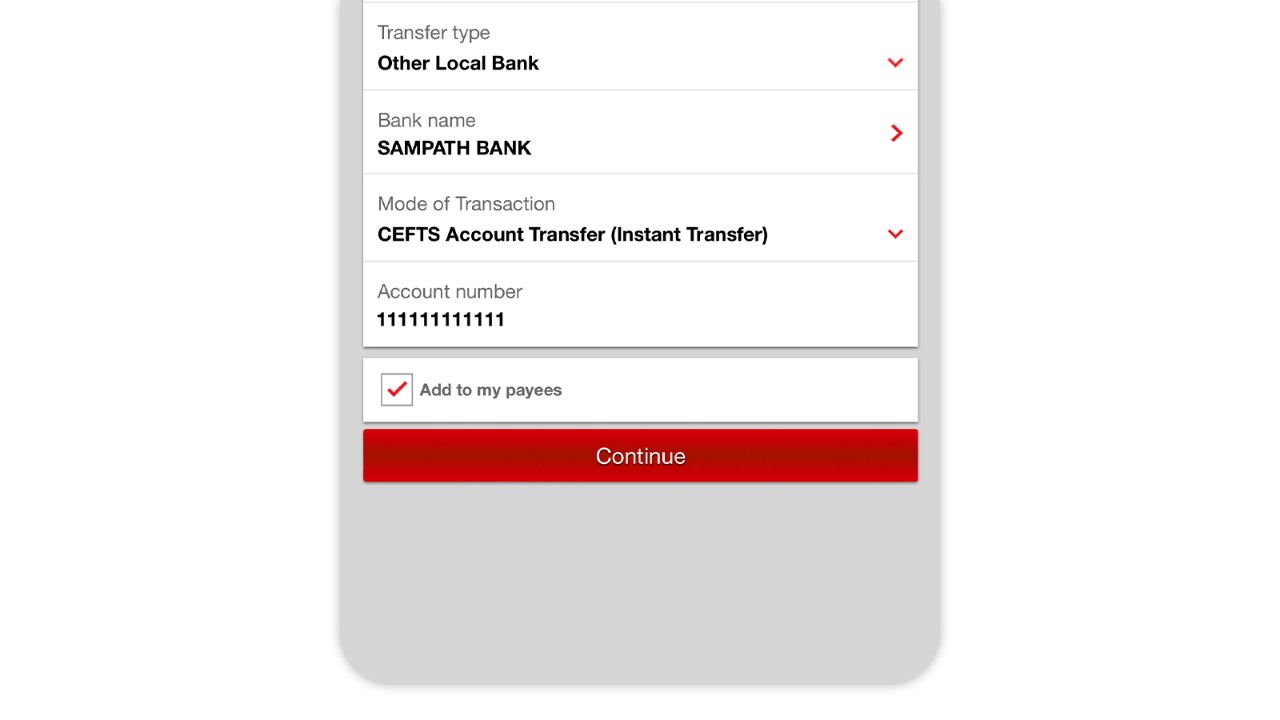

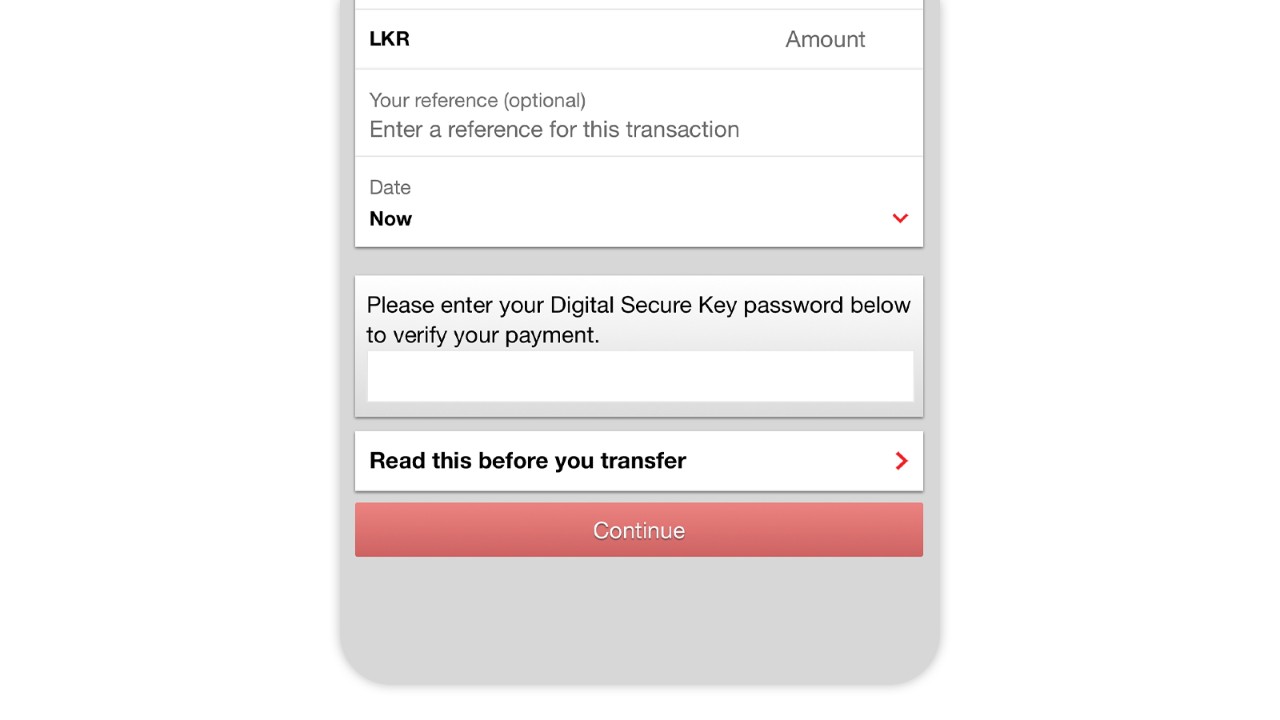

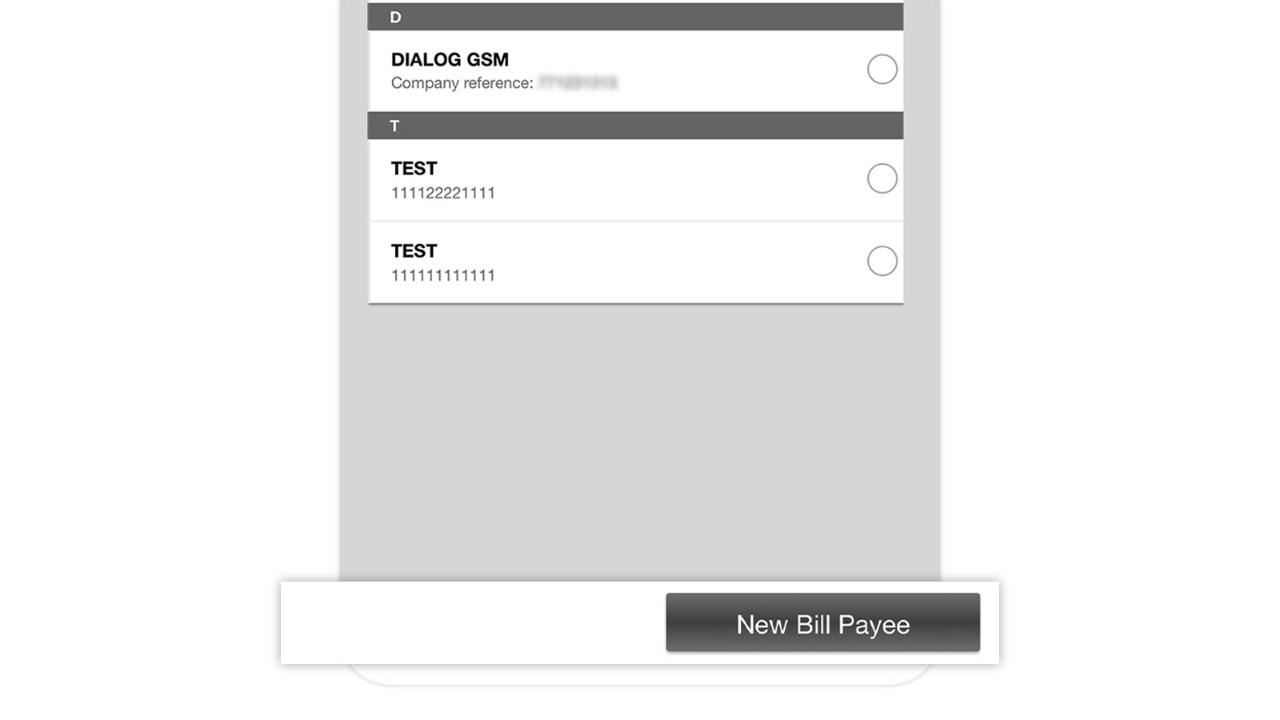

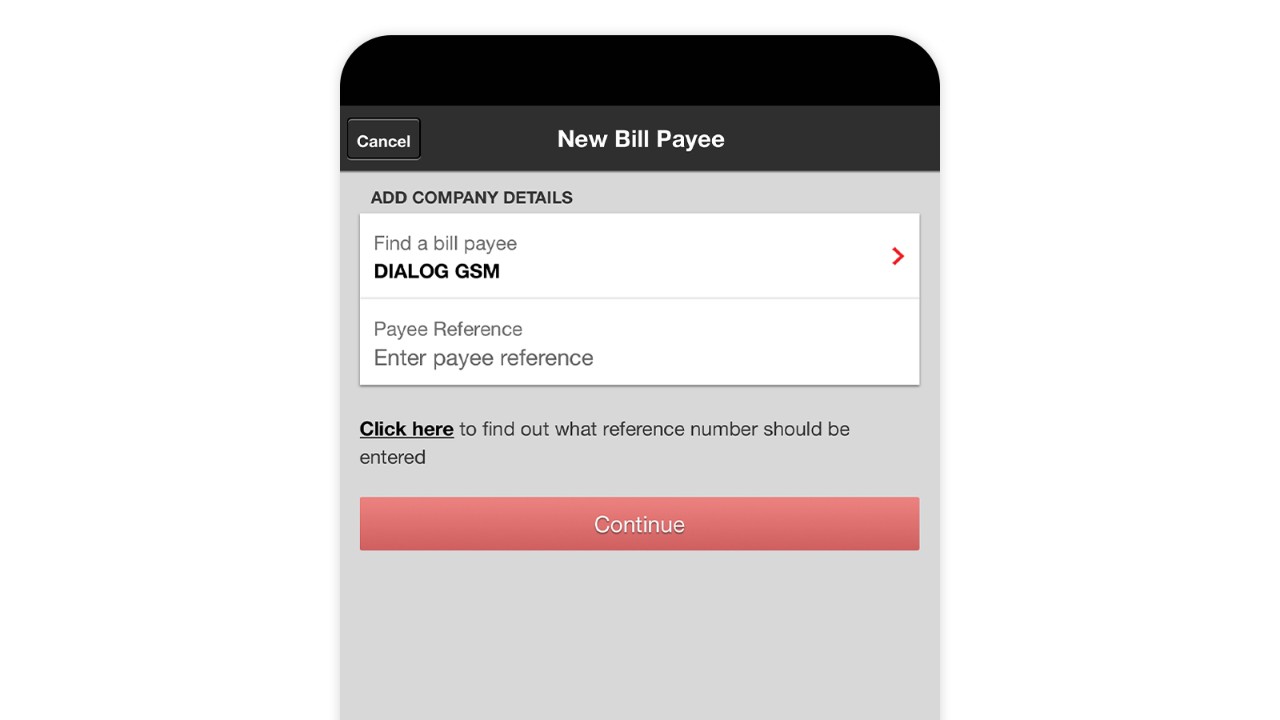

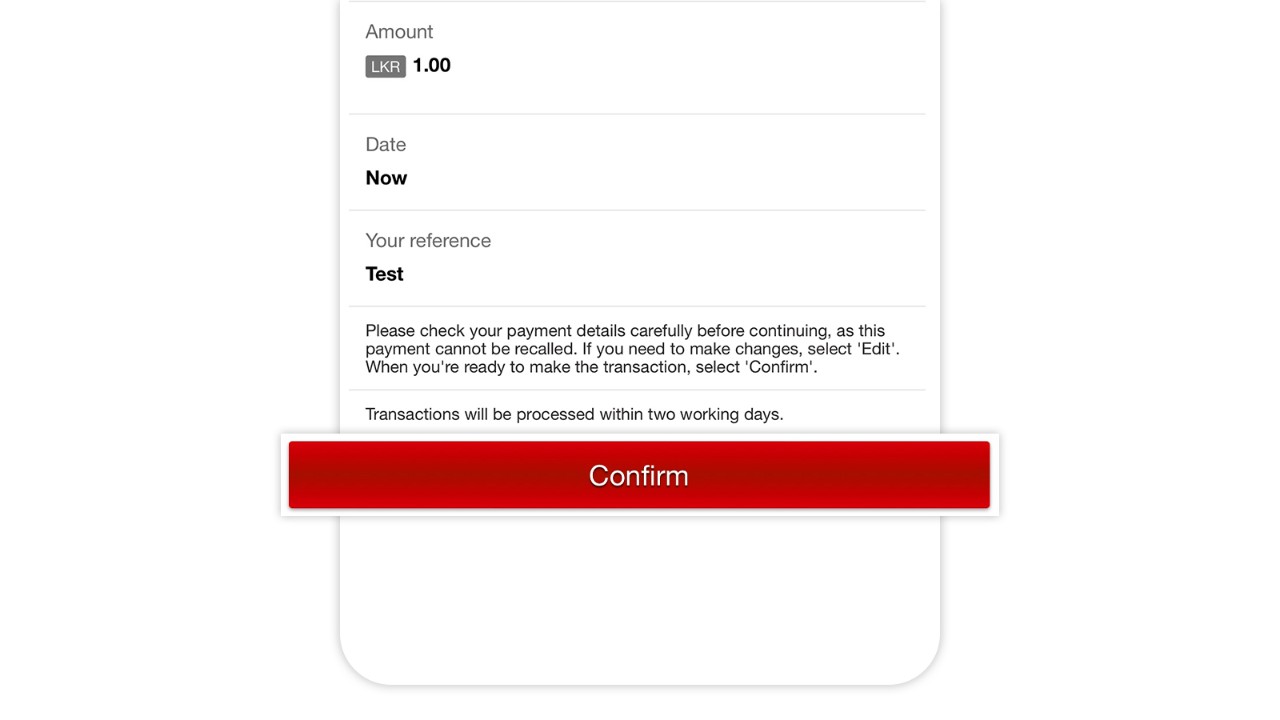

Steps to make a transfer or bill payment to a new payee on your Mobile Banking App

Make transfers or bill payments to a payee that hasn't been saved on the app before.

Learn how to enable Face ID / Touch ID for Making transfers to new payees

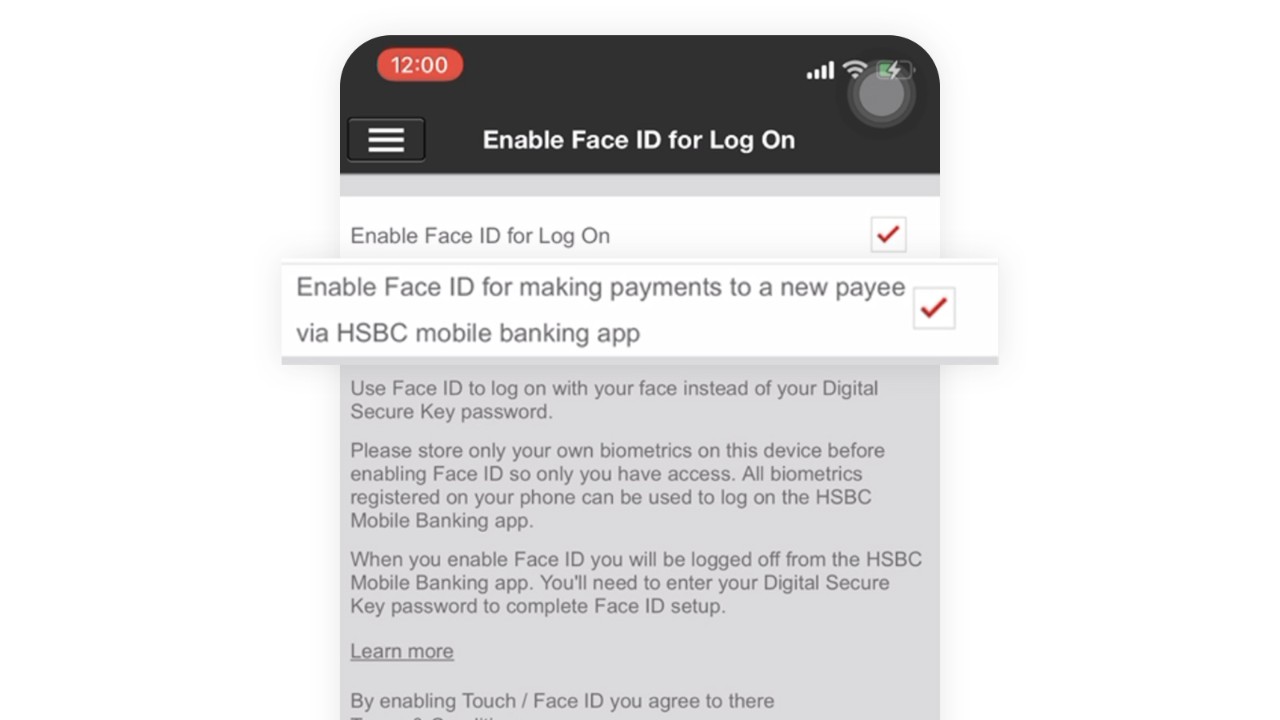

Note : Face ID and Touch ID should be supported by the iPhone model. Also, Face ID or Touch ID is not supported on Android phones.

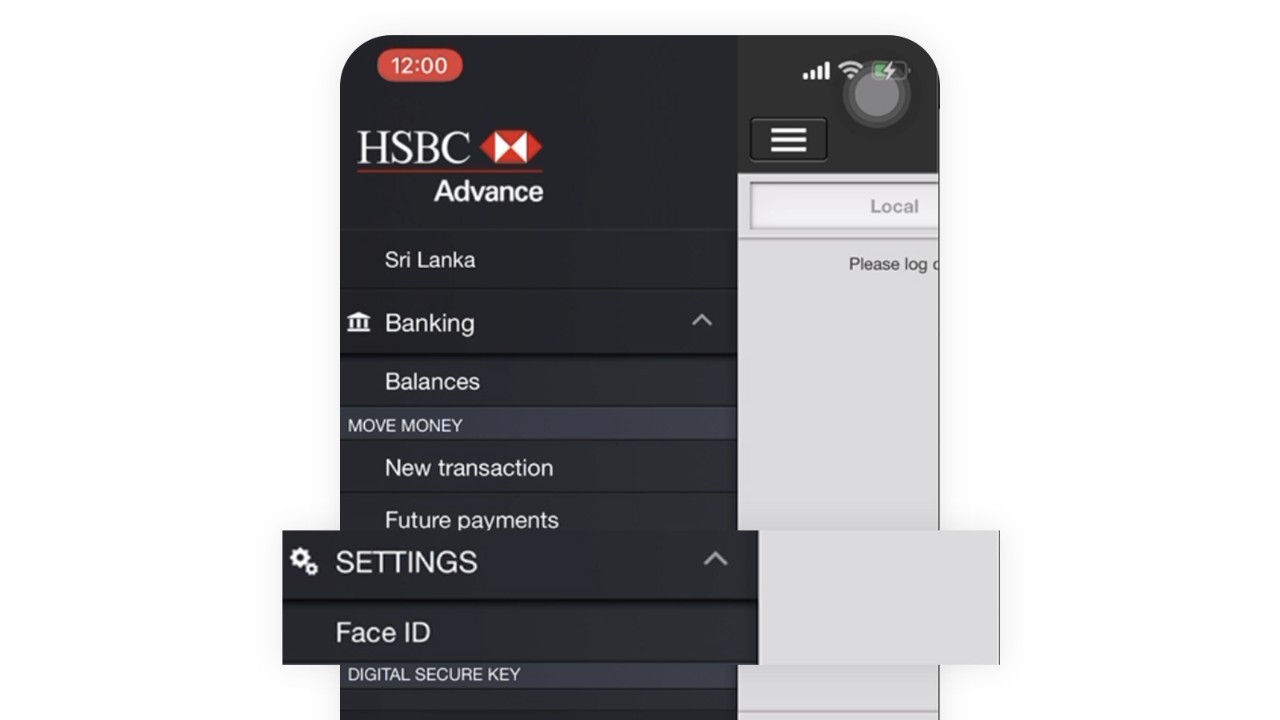

Step 1 : Click on “Settings’ from the left hand menu and select ‘Face ID/Touch ID”

Step 2 : Tick the box under “Enable Face ID /Touch ID for making payments to a new payee via HSBC mobile banking app”

Frequently asked questions

Other ways to bank

Online banking

Bank securely at the branch that never closes.

eStatements

Choose to receive eStatements instead of paper statements.

Telephone banking

Keep on top of your finances by phone.